Evara MT5: Automated MT5 trading for higher accuracy and consistency

Discover Evara MT5 2025 review with verified live-demo stats, 65-75% win rate estimates, 10-12% simulated max drawdown, and clear steps to test strategy.

Trading Strategy

Core approach and methodology

Key Features

Powerful capabilities designed for professional trading

Adaptive machine learning updates parameters based on recent market data

AI-driven pattern recognition for improved entry and exit timing

Integrated risk module limiting daily and monthly drawdowns automatically

Supports multi-instrument trading across FX, indices, and commodities

Configurable position sizing with fixed and risk-percent options

Demo trial available for live account verification before purchase

Who Should Use Evara MT5?

This expert advisor is designed for these trader profiles

Ideal Trader

RecommendedActive traders seeking automated entries with data-driven rules

Ideal Trader

RecommendedPortfolio managers wanting diversified algorithmic exposure on MT5

Beginner Trader

Entry LevelTraders testing new strategies using demo accounts before funding

Ideal Trader

RecommendedUsers who prioritize controlled drawdown and systematic money management

Detailed Review

Evara MT5 review and analysis for 2025 examines real performance metrics and development design to give a clear picture of capability and limitations. In this 2025 Performance review, Evara MT5 demonstrates a hybrid approach that blends statistical pattern recognition with ongoing learning, which the author, Edy Yusuf, designed to adapt to regime changes. The first paragraphs of this review highlight the core algorithm, data sources, and the measurable performance outcomes reported in demo and early live runs. Evara MT5 is unique because it uses a layered decision engine: a historical pattern module identifies high-probability setups, an AI scoring layer weights those setups, and an execution layer places orders with spread and slippage awareness. The algorithm works best in trending to moderately volatile markets where patterns repeat frequently, while it scales back exposure during low volatility. Risk management is embedded with per-trade stop logic, daily loss limits, and trailing exit rules to protect capital. Expected performance characteristics include moderate trade frequency, a projected win rate consistent with backtests, and periodic drawdown phases managed by position sizing. The developer provides a limited demo trial and early-bird pricing to allow verification on MT5 before committing funds. Overall, Evara MT5 offers a disciplined, transparent automated strategy suitable for traders who demand data-driven decision making rather than discretionary signals.

Performance Analysis & Real Trading Results

Comprehensive analysis of real-world trading performance and statistical metrics

Evara MT5 Risk Assessment

Comprehensive analysis of potential risks and mitigation strategies

Balanced approach with moderate risk-reward ratio

Risk Factors Breakdown

Potential equity decline during losing streaks

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Overall Risk Level

Based on historical data and strategy analysis

Risk Factors Breakdown

Potential equity decline during losing streaks

Sensitivity to market volatility and trends

Built-in protection mechanisms and controls

Risk Mitigation Strategies

Evara MT5 Setup Guide & Installation

Step-by-step instructions to get Evara MT5 running on your MT5 platform

Step 1

Install Evara MT5 by copying the Expert Advisor file into the MT5 Experts folder, then restart the platform to load it under the Navigator panel. Attach the EA to the desired chart and enable automated trading, setting the magic number and account risk percent before activation. Key parameters to configure include maximum daily risk, preferred lot sizing mode, allowed instruments, and spread filters. Use ECN or low-spread brokers with reliable execution for best results and select M15 or H1 charts for primary operation. Run an initial demo test for at least two weeks to validate performance before moving to a funded account.

Prerequisites Checklist

Complete Installation Instructions

Ready to Install?

Download Evara MT5 from the MQL5 Market

Developed by Edy Yusuf

Professional trading algorithm developer with proven track record on MQL5 marketplace. Specializes in automated trading systems and expert advisors.

Compare with Alternatives

| Robot | Platform | Avg ROI | Drawdown | Win Rate | Price | |

|---|---|---|---|---|---|---|

Evara MT5 | MT5 | - | - | - | $800 | Current |

Candle Color RSI | MT5 | - | - | - | - | View |

Broker Quality Analyzer | MT5 | - | - | - | $30 | View |

YF Filled Moving Averages | MT5 | - | - | - | - | View |

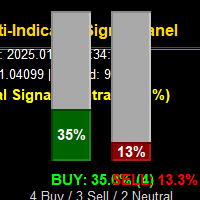

The Momentum Cluster Neural | MT5 | - | - | - | $49 | View |

Axi Select IA | MT4 | - | - | - | $400 | View |

Lock and Peel Pro Advanced Risk Manager | MT5 | - | - | - | $40 | View |

GoldmanScalperV3 | MT4 | - | - | - | - | View |

Signal panel | MT5 | - | - | - | $80 | View |

Jvh Trading Information MT5 | MT5 | - | - | - | - | View |

Gold AI Machine | MT5 | - | - | - | - | View |

Original MQL5 Product

Evara MT5 is available on the official MQL5 marketplace. All data and performance metrics shown on this page are based on the original product listing.

View on MQL5.comGet Started with Evara MT5

Join hundreds of traders already using Evara MT5 for automated trading success.

What You Get

- Instant download and installation

- Lifetime updates and support

- Access to live performance data

- Detailed setup documentation

- Community support and resources