At this time, purchasing EASY Bot items is not available to all members. Read more - how to get access to purchase

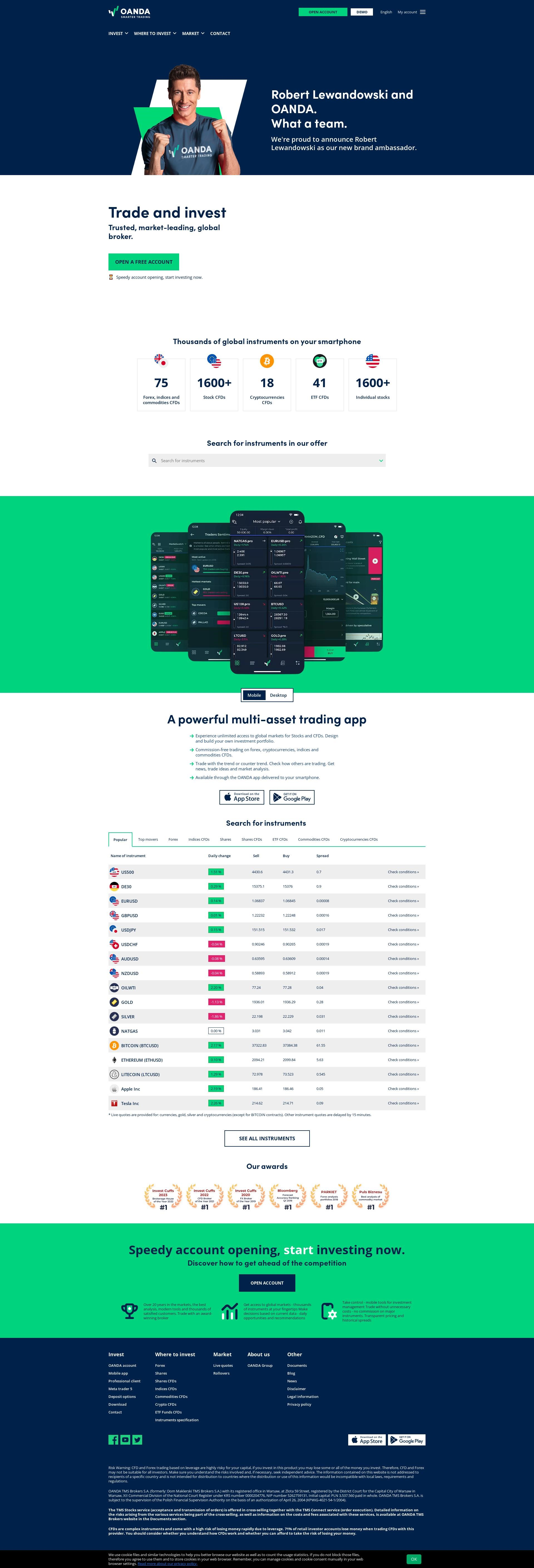

Oanda

Welcome to our comprehensive review of Oanda, a globally recognized forex broker with a solid track record spanning over 25 years. With regulatory oversight in the US, UK, Canada, and Australia, Oanda has carved a niche for itself in the global forex trading industry. The company has a strong presence in North America, Europe, Australia, and Asia, offering its clients access to over 70 currency pairs, commodities, and precious metals through platforms such as MetaTrader 4, Trading View, and Trade Web. In addition to its forex brokerage services, Oanda is also known for its currency transfer services and MarketPlus trading analytics. The company's commitment to providing a seamless trading experience is evident in its low minimum trade size of 0.01 and maximum leverage of 200:1. With a minimum opening balance of just $1, Oanda is accessible to traders of all levels. Despite its global footprint, Oanda maintains a strong local presence, with its headquarters located at 10 Times Square, New York. The company is regulated by several authorities including ASIC, IIROC, FFAJ, MFSA, MAS, FCA, CFTC, NFA, and BVI FSC. Oanda offers a range of trading platforms including MT4, MT5, WebTrader, NinjaTrader, MotiveWave, MultiCharts, and TradingView. Traders can also enjoy the flexibility of web and mobile trading. The company supports trading in over 70 currencies, four cryptocurrencies, and over 50 CFDs including gold, silver, other precious metals, stock indexes, bonds, oil, and other commodities. This review aims to provide an unbiased look at Oanda's services, trading conditions, and more. We invite you to share your live trading experiences with Oanda.

Established in 1996, Oanda has been a prominent player in the forex trading industry for over 25 years. This forex broker has a global presence, with offices in North America, Europe, Australia, and Asia.

Regulation and Safety

Oanda is regulated in several countries, including the US, UK, Canada, and Australia. It holds licenses from ASIC, IIROC, FFAJ, MFSA, MAS, FCA, CFTC, NFA, and BVI FSC. This extensive regulatory oversight enhances the trustworthiness and reliability of Oanda as a forex broker.

Trading Platforms and Instruments

Oanda offers a variety of trading platforms, including MetaTrader 4, Trading View, and Trade Web platforms. Traders can access over 70 currency pairs, commodities, and precious metals. Additionally, Oanda supports online trading and mobile trading, providing flexibility for traders on the go.

Trading Conditions and Services

Oanda offers a minimum trade size of 0.01 and a maximum leverage of 200:1. It also supports Expert Advisors (EAs), news trading, and scalping. Oanda is also known for its currency transfer services and MarketPlus trading analytics, providing a comprehensive suite of financial services for its clients.

Deposit and Withdrawal Methods

Oanda offers a wide range of deposit and withdrawal methods, including bank wire, VISA, MasterCard, ACH Payments, BPAY, CHAPS, Check, DBS Bill Payment, Local Bank Deposits, Local Bank Transfers, Neteller, Payment Asia, PayNow, PayPal, SEPA Credit Transfer, and Skrill.

Safety Check

With its extensive regulatory oversight and a long-standing reputation in the industry, Oanda is generally perceived as a safe and reliable forex broker. However, as with any financial institution, it is always advisable for traders to conduct their own due diligence.

Pros and Cons

Some of the advantages of Oanda include its wide range of trading platforms and instruments, comprehensive financial services, and extensive regulatory oversight. On the other hand, some traders might find the maximum leverage of 200:1 to be relatively low compared to other forex brokers.

Scammer or Not?

Given the extensive regulatory oversight and long-standing reputation of Oanda, it is unlikely to be a scam. However, traders should always be vigilant and conduct their own research before engaging with any forex broker.

Frequently Asked Questions

Is Oanda a reliable forex broker?

Yes, Oanda is generally perceived as a reliable forex broker due to its extensive regulatory oversight and long-standing reputation in the industry.

What trading platforms does Oanda offer?

Oanda offers a variety of trading platforms, including MetaTrader 4, Trading View, and Trade Web platforms.

What financial services does Oanda provide?

In addition to forex trading, Oanda also offers currency transfer services and MarketPlus trading analytics.

Please visit forexroboteasy.com to share your experiences with Oanda. This independent review aims to provide a comprehensive look at Oanda as a forex broker and does not contain any personal recommendations or conclusions.

forexroboteasy.com

Experiencing the financial market environment through the lens of Oanda's trading platform has been my routine for the last substantial period of five years. It was a relationship built on trust, however, recent occurrences have led to an unfortunate disconnection. This write-up utters a clear recount of why I am turning the page and seeking solace in a new trading platform. Oanda and I shared an engaging dance in the trading market that spanned over half a decade. While trading, protective stop losses have always been one of my trusted strategies, a secure backup plan. But my maestro Oanda let me down, betraying my trust with its slippage not once but multiple times by stopping me out. It has extended to an unfathomable limit wherein, on numerous occasions, stops were placed four times wider than where I originally set my protective stop loss. I extended an olive branch, allowing room for investigation and expecting resolutions that would provide some solace to this heated disappointment. Yet, Oanda, in all its glory, came back with denials, asserting that the orders executed as they were originally intended. To a seasoned trader, this felt like Oanda, continued to pour salt on an already painful wound. Having experienced the trading sphere for a substantial period of time, I can allow a degree of slippage in transactions. It is, after all, an integral part of the game churned out by rapid fluctuations in the financial market. However, the kind of perpetual inconsistency I've lately experienced with Oanda is a deviation too far from my tolerant limits. In light of these events, I feel compelled to share my experience with fellow traders. Warning signs are there and if you're trading with Oanda, it might be prudent to tread carefully. I admit that every trading platform might have its fissures, but when the trust cracks, it's time to hunt for a replacement. In conclusion, I find it extremely challenging to recommend Oanda to fellow traders or aspirants. While the course of my journey with Oanda has seen its fair share of highs and lows, a trust deficit of such magnitude has left me with no other option but to bid farewell.

I have had a lengthy trading relationship with Oanda, lasting around five solid years. The experiences have been quite a journey, and I believe sharing my viewpoints could provide genuine insights for potential traders seeking a reliable platform. The appeal of Oanda was initially strong, and I was drawn towards their seemingly tantalising trading conditions. However, this perspective has drastically changed recently due to a consistently recurring issue that I believe potential clients must be alerted to - their stop-loss execution. A protective 'stop loss' position is a critical safety net that any seasoned trader is familiar with. It’s a strategy employed to prevent significant losses if market conditions suddenly swing against your favor. My experience with Oanda, unfortunately, entails witnessing my stop-losses being extended 4x wider than where I originally set them. This isn’t just a minor annoyance; it's a significant fluctuation that has unfairly propelled me into deeper losses rather than protecting me from them. So, why has this happened time and time again? It's a question I asked Oanda's team, hoping for a reasonable explanation or, at the very least, an acknowledgment of the issue. Yet, their response was vague, stating that upon 'investigating', the order was executed exactly as it should be. To me, it's a standard avoidance tactic instead of an assurance to fix the problem. Slippage is one thing - a phenomenon that traders understand as the difference between the expected price of a trade and the actual price where the trade is executed. It can occur due to market volatility during economic events or news releases, and it's something I am willing to tolerate to an extent. However, the problem becomes momentous when it's not just about occasional slippage, but recurrent incidences that make trading untenable. In terms of recommendations, based on the recent revelations, I have to assert that I would not endorse Oanda as a preferred trading platform, at least from my personal experience. I believe in the importance of a reliable broker that gives its traders the assurance of stable executions, which in my experience, Oanda has failed to deliver. For anyone considering their service, I would advise to tread carefully and factor in these unintended, potential blows to your investment. To conclude, as I prepare to transition to a new trading platform, I intend to carry the experience as a lesson learned. While no platform is perfect, the protective stop loss' reliability is a crucial aspect that should never be compromised. There are numerous other platforms available that value their client's investment and offer clearer policies on these critical mechanisms, making the trading journey less turbulent.

For half a decade, I have been a dedicated user of Oanda, navigating its trading tools with the solid belief that it offers security and reliability for my investment. Unfortunately, my confidence in this platform has been significantly shaken due to its repeated stop loss issues. It is heartbreaking when you pour your faith into a platform and they betray it, as Oanda has done. Throughout my journey with Oanda, its major pitfall has been its stop loss execution - a critical aspect of trading regulations that it has unfortunately mismanaged too many times. A protective stop loss is meant to safeguard your investments from sinking beyond a particular level. Experience, however, has shown that Oanda's implementation of this crucial aspect of trading proves problematic. Where I had set my protective stop loss, Oanda astonishingly stopped me out 4 times wider. Not once, not twice, but numerous times, they have upended my trading strategy, thrusting me into a pit of unanticipated losses. Each incident hinted me at the uncomfortable truth - my trading experience is not truly protected and regulated as Oanda claims it to be. Hopeful for a resolution, I reached out to their support team, expecting them to address the technical glitches and compensate for the unplanned detriments caused. However, their response was far from satisfying. The platform denied any wrongdoing, asserting that the order was executed as intended after their so-called 'investigation.' I understand that slippages are a part of the trading process and I am willing to absorb the minor ones. But what Oanda seems to promote is not slippage - it's a wide, gaping discrepancy that can be disastrous for traders like you and me. It's not something I can continue to tolerate. The eerie shadow of doubt cast over me by these unfortunate incidents has left me with no choice but to reconsider my association with the platform. Consequently, with regret, I find myself compelled to find another trading platform that values customer security and satisfaction as much as it claims. Given my first-hand experience, I would not recommend Oanda as an ideal trading platform for any trader. So, tread with caution; consider not just their promised features but also look out for how they handle the critical aspects of trading and customer satisfaction. Your hard-earned money deserves a home that guarantees security and respect, not a mild acknowledgment of fault. Sharing this review is my earnest attempt to elucidate fellow traders about the lurking uncertainties associated with trading on Oanda. Armed with these insights, I hope you make an informed decision about your chosen trading platform.

Having been an active trader with Oanda for approximately five years, I've recently decided to take my business elsewhere, after multiple unsatisfactory experiences with their stop loss execution. Oanda, a platform I once trusted and associated with profitability, has consistently stopped me out with a margin four times wider than where I had my 'protective' stop loss set. This unfortunate situation has happened often enough to force me to reassess my choice of trading platform. Despite the fact that my stop loss was set as a 'safety net', I was hit hard by Oanda's actions. They have disputed my claims, insisting that the order was executed exactly as intended. I was willing to accommodate some slight slippage considering market volatility, but the frequency and scale of Oanda's shortfalls have surpassed what can be considered acceptable or justifiable. After my own prompt investigations, their response was less than satisfactory. Oanda staunchly defended their systems, further fueling my concern about their reliability. The issue of trust and reliability is paramount when it comes to trading platforms. This is why the decision to leave Oanda after five years of trading was not easy. However, to endure such high slippage frequency undercuts the underlying motive of setting a stop loss in the first place. My personal, long-term experience suggests that Oanda does not provide adequate protection for the trader's capital, particularly when it comes to honor the stop loss settings. With this in mind, I cannot endorse Oanda as a trustworthy or reliable trading platform. For newbie traders or experienced counterparts considering Oanda, my five years of experience serve as a cautionary tale. I, unfortunately, would strongly not recommend entrusting your capital and trust in trading with Oanda. Assess your options carefully before taking the plunge!