At this time, purchasing EASY Bot items is not available to all members. Read more - how to get access to purchase

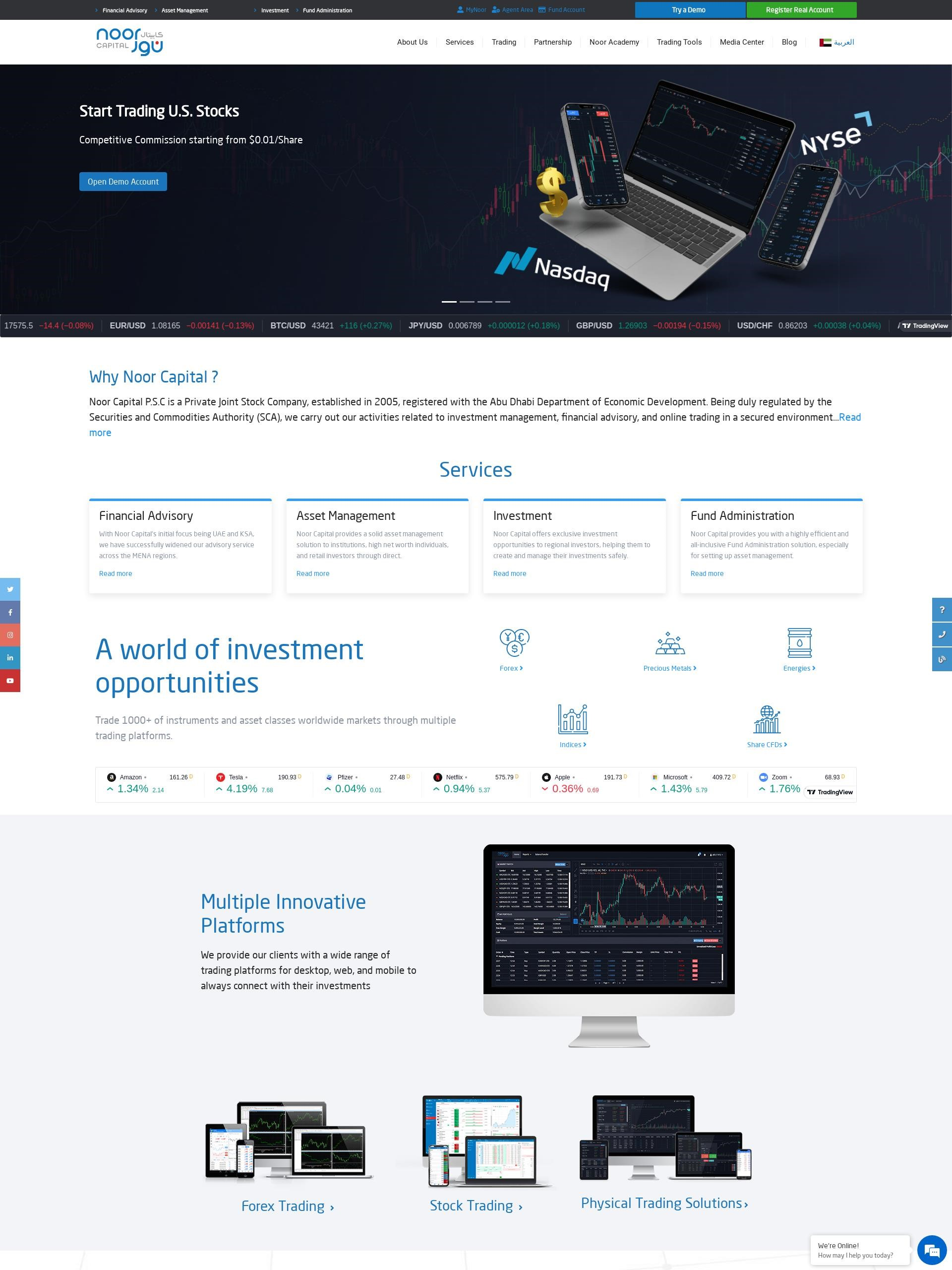

NoorCapital.ae

In this article, we delve into the operations and offerings of NoorCapital.ae, a forex broker that has been in the financial market since 2005. Headquartered in Abu Dhabi, United Arab Emirates, NoorCapital provides an array of trading options to its clients, including over 45 forex currency pairs, cfds, soft commodities, cash indices, energies, stocks, gold, and silver. The company operates on the MT4, MT4 Web, and Mobile forex trading platforms, offering a minimum trade size of 0.01 and a maximum leverage of 400:1. With a minimum opening live trade of just $50, NoorCapital caters to both novice and seasoned traders. Regulated by the Central Bank, NoorCapital offers a broad spectrum of trading instruments, including 70 CFDs for gold, silver, and other commodities. The company also supports automated trading with EAs/Robots and offers MAM and PAMM accounts for social trading. For transactions, NoorCapital accepts bank wire transfers, Visa, and MasterCard for deposits, while withdrawals are processed via bank wire transfers. As we explore further in this review, we aim to provide an unbiased examination of NoorCapital's services, trading conditions, and overall performance in the forex market.

Established in 2005, NoorCapital has made a name for itself in the Forex trading industry. This Forex Broker is based in Abu Dhabi, United Arab Emirates, and offers a variety of trading options to its clientele. The company provides a robust platform for Forex trading, with a focus on diversity and flexibility.

Trading Platforms and Options

NoorCapital offers its clients the top trading platforms: MT4, MT4 Web, and Mobile Forex Trading. These platforms are renowned for their user-friendly interfaces and advanced trading features, making them suitable for both novice and experienced traders. The broker offers over 45 forex currency pairs, CFDs, soft commodities, cash indices, energies, stocks, gold, and silver for personal investment and trading options.

Trading Conditions

The trading conditions provided by NoorCapital.ae are accommodating to different trading styles. The broker supports Expert Advisors (EAs) and Robots, allowing traders to automate their trading strategies. News Trading and Scalping are also permitted, providing traders with the flexibility to exploit short-term market fluctuations.

Account Management Options

NoorCapital offers both MAM and PAMM account options, making it a viable choice for money managers and investors looking for managed account solutions. The broker provides these advanced account management tools to help traders optimize their trading strategies and manage multiple accounts efficiently.

Deposits and Withdrawals

The broker offers several deposit methods including Bank Wire (BankTransfer/SWIFT), VISA, and MasterCard. For withdrawals, traders can use Bank Wire (BankTransfer/SWIFT). The minimum deposit to open a live trading account is $50, making it accessible for traders with different investment capacities.

Regulation and Safety

NoorCapital is regulated by the Central Bank with the number #1003525, which adds to its credibility and trustworthiness. However, as with any online trading platform, traders are advised to exercise caution and do their due diligence before investing.

Pros and Cons

Pros of NoorCapital include a wide range of trading options, user-friendly trading platforms, and flexible trading conditions. The broker also offers advanced account management tools and a variety of deposit methods. However, the cons include a limited number of withdrawal methods and the absence of cryptocurrency trading.

Scammer or Not?

Given the regulation by the Central Bank and its long-standing operation since 2005, NoorCapital does not appear to be a scam. However, traders are always advised to conduct their research and consider user reviews before investing.

FAQs

What trading platforms does NoorCapital offer?

NoorCapital offers MT4, MT4 Web, and Mobile Forex Trading platforms.

What is the minimum deposit to open a live trading account with NoorCapital?

The minimum deposit to open a live trading account is $50.

Is NoorCapital a regulated broker?

Yes, NoorCapital is regulated by the Central Bank with the number #1003525.

Does NoorCapital allow scalping and news trading?

Yes, NoorCapital permits both scalping and news trading.

For more comprehensive user experiences and reviews about NoorCapital, visit forexroboteasy.com. This independent review is intended to provide a neutral overview of the broker. It does not contain any recommendations or personal opinions. Please remember that Forex trading involves risk, and it is important to conduct thorough research before committing any capital.

forexroboteasy.com